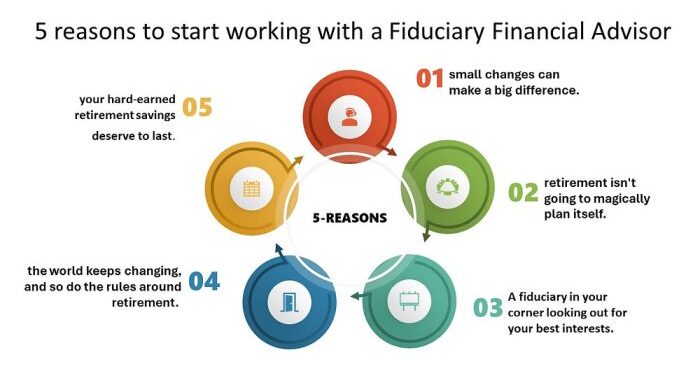

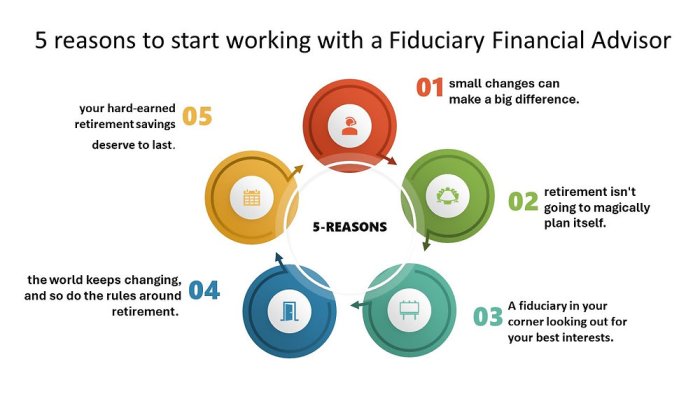

Benefits of Working with a Fiduciary Financial Advisor sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a casual formal language style and brimming with originality from the outset.

As we delve deeper into the realm of fiduciary financial advisors, a world of trust, transparency, and personalized financial planning unfolds before us, shedding light on the advantages of this professional partnership.

Benefits of working with a fiduciary financial advisor

When seeking financial advice, working with a fiduciary financial advisor can offer numerous advantages. These professionals operate under a fiduciary duty, ensuring they prioritize their clients’ interests over their own.

Explain the concept of fiduciary duty in financial advisory services

A fiduciary duty refers to the legal obligation that financial advisors have towards their clients. This duty requires advisors to act in the best interests of their clients at all times, providing recommendations and guidance that align with the clients’ financial goals and objectives.

Identify how fiduciaries prioritize clients’ interests over their own

- Fiduciary advisors are committed to putting their clients’ needs first, even if it means recommending solutions that may not result in the highest commissions or fees for themselves.

- They are transparent about their compensation structure and any potential conflicts of interest, ensuring clients are aware of how their advisor is compensated.

Describe the legal obligations fiduciaries have towards their clients

- Fiduciaries are required to provide advice that is solely in the best interest of their clients, without any external influences affecting their recommendations.

- They must disclose any potential conflicts of interest and ensure that all investment decisions are made with the client’s financial well-being as the top priority.

Compare fiduciary advisors to non-fiduciary advisors in terms of responsibilities and client benefits

- Fiduciary advisors are held to a higher standard of care compared to non-fiduciary advisors, as they are legally obligated to act in the best interests of their clients.

- Clients working with fiduciaries can have greater peace of mind knowing that their advisor is working towards their financial goals without any conflicts of interest influencing the advice given.

Transparency and trust

Transparency and trust are crucial elements in any financial advisory relationship. When working with a fiduciary financial advisor, these aspects are further enhanced, leading to a more fruitful partnership between the advisor and the client.Fiduciaries are bound by law to act in their clients’ best interests at all times.

This commitment to prioritizing the client’s needs above all else promotes transparency in financial dealings. Clients can trust that the advice and recommendations provided by a fiduciary are not influenced by any external factors, such as commissions or incentives.

Enhanced transparency

- Fiduciaries disclose all fees and potential conflicts of interest upfront, ensuring clients are fully aware of the costs involved in their financial plan.

- They provide detailed reports and documentation regarding investment performance, allowing clients to track the progress of their portfolio with clarity.

- Any changes to the financial plan or investment strategy are communicated promptly, keeping the client informed every step of the way.

Building trust with clients

- Fiduciaries prioritize open communication and active listening, creating a safe space for clients to express their financial goals and concerns without judgment.

- They take the time to educate clients about complex financial concepts, empowering them to make well-informed decisions about their money.

- By consistently delivering on their fiduciary duty, fiduciaries earn the trust and confidence of their clients, establishing a long-lasting professional relationship built on mutual respect.

Contributing to a strong advisor-client relationship

- Transparency and trust form the foundation of a strong advisor-client relationship, fostering collaboration and shared decision-making between the parties.

- Clients feel more secure in their financial future when they trust their advisor to act in their best interests, leading to a deeper level of engagement and commitment to the financial plan.

- Ultimately, transparency and trust create a positive feedback loop in the advisor-client relationship, where both parties benefit from a sense of mutual respect and integrity.

Conflict of interest avoidance

When working with a fiduciary financial advisor, one of the key benefits is the avoidance of conflicts of interest. Fiduciaries are legally obligated to act in their clients’ best interests, prioritizing them above all else.

By mitigating conflicts of interest, fiduciaries ensure that the financial advice and recommendations provided are solely based on what is best for the client’s financial well-being, without being influenced by outside factors.

Examples of common conflicts of interest

- Selling proprietary products: Some financial advisors may recommend products that are affiliated with their firm, even if there are better options available in the market.

- Receiving commissions: Advisors who receive commissions for selling certain financial products may be incentivized to recommend those products over others that may be more suitable for the client.

- Churning: Some advisors may excessively trade in a client’s account to generate more commissions, without considering the client’s best interests.

Importance of conflict-free advice

Conflict-free advice is crucial in helping clients achieve their financial goals. By receiving advice that is free from conflicts of interest, clients can trust that their advisor is making recommendations solely based on what is best for them, helping them make informed decisions that align with their objectives.

Personalized financial planning

Personalized financial planning is a crucial aspect of working with a fiduciary financial advisor. These professionals take the time to understand each client’s unique financial situation, goals, and risk tolerance in order to create a customized financial plan that aligns with their individual needs.

Tailoring financial plans

Fiduciary advisors tailor financial plans to individual client needs by conducting a comprehensive financial assessment. They consider factors such as income, expenses, assets, liabilities, investment preferences, and future financial goals. By taking a holistic view of a client’s financial picture, fiduciary advisors can create a personalized plan that addresses their specific circumstances.

- They develop customized investment strategies that align with the client’s risk tolerance and long-term financial objectives.

- They offer personalized recommendations for retirement planning, tax optimization, estate planning, and other financial goals based on the client’s unique situation.

- They regularly review and adjust the financial plan as needed to ensure it remains aligned with the client’s changing circumstances and goals.

Summary

In conclusion, the journey through the Benefits of Working with a Fiduciary Financial Advisor unveils a landscape where clients’ interests are paramount, conflicts of interest are avoided, and financial plans are tailored to individual needs. By choosing a fiduciary advisor, clients embark on a path towards financial security and peace of mind.

User Queries

What is fiduciary duty in financial advisory services?

Fiduciary duty refers to the legal obligation of a financial advisor to act in the best interests of their clients, prioritizing client needs over their own.

How do fiduciaries build trust with their clients?

Fiduciaries build trust by being transparent in their dealings, providing conflict-free advice, and tailoring financial plans to suit individual client needs.

Why is conflict of interest avoidance important in financial planning?

Avoiding conflicts of interest ensures that clients receive unbiased advice and recommendations that are solely in their best interests, leading to better financial outcomes.