Delving into the realm of institutional investors and their influence on stock movement, this topic sheds light on the intricacies of how these key players shape the financial landscape. From pension funds to hedge funds, their actions have far-reaching consequences that impact market dynamics in profound ways.

As we explore the various facets of institutional investors and their impact on stock prices, a deeper understanding emerges of the nuanced relationship between their strategies and market fluctuations.

Overview of Institutional Investors

Institutional investors play a significant role in financial markets, as they are large entities that invest funds on behalf of others. These investors can include pension funds, mutual funds, insurance companies, and hedge funds.

Role of Institutional Investors

Institutional investors are responsible for managing large sums of money on behalf of their clients or members. They often have a long-term investment horizon and can influence stock prices through their buying and selling activities.

Examples of Institutional Investors

- Pension Funds: These are funds set up by employers to provide retirement benefits for employees.

- Mutual Funds: These are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of securities.

- Insurance Companies: These entities invest premiums collected from policyholders to generate returns.

- Hedge Funds: These are private investment funds that can use a variety of strategies to achieve high returns for their investors.

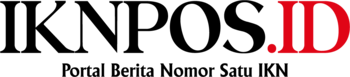

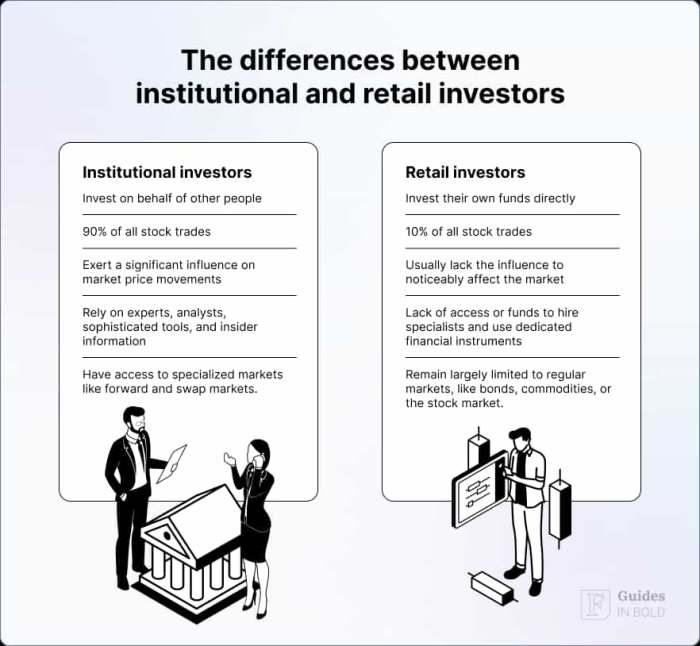

Differences from Retail Investors

Institutional investors differ from retail investors in several ways. Institutional investors typically have access to more resources, sophisticated research capabilities, and professional expertise compared to retail investors. They also have the ability to move markets with their large trades and often focus on long-term investment strategies rather than short-term gains.

Impact of Institutional Investors on Stock Prices

Institutional investors, due to their large trading volumes, have a significant impact on stock prices. Their actions can create substantial movements in the market, influencing the overall direction of stock prices.

Institutional Ownership and Stock Movement

Institutional ownership refers to the percentage of a company’s shares held by institutional investors such as pension funds, mutual funds, and hedge funds. The higher the institutional ownership of a stock, the more influence these investors have on its price movements.

When institutional investors buy or sell large quantities of shares, it can lead to significant price fluctuations. For example, if a mutual fund decides to sell off a large portion of its holdings in a particular stock, it can cause the stock price to drop due to increased supply and decreased demand.

Creation of Market Trends by Institutional Investors

Institutional investors play a crucial role in shaping market trends through their collective actions. For instance, if a group of institutional investors collectively decides to invest heavily in a specific sector, it can lead to a surge in stock prices within that sector.

This can create a domino effect, as other investors may follow suit, further driving up prices. Conversely, if institutional investors start offloading shares in a particular industry, it can trigger a downward trend as other investors may perceive it as a signal to sell as well.

Influence of Institutional Investment Strategies

Institutional investors play a significant role in the stock market, and their investment strategies can have a profound impact on stock movement. Let’s delve into the common strategies employed by institutional investors and how these strategies are influenced by market sentiment and economic indicators, ultimately affecting stock prices.

Common Investment Strategies

- Passive Investing: Institutional investors may opt for passive investment strategies like index funds or exchange-traded funds (ETFs) to track a specific market index. This strategy aims to replicate the performance of the overall market rather than outperforming it.

- Active Investing: On the other hand, institutional investors may engage in active investing, where they actively buy and sell securities in an attempt to outperform the market. This strategy involves in-depth research, analysis, and decision-making to generate alpha.

- Value Investing: Institutional investors may follow a value investing approach, focusing on buying undervalued stocks with the potential for long-term growth. This strategy involves assessing the intrinsic value of a stock compared to its market price.

Factors Influencing Decision-Making

- Market Sentiment: Institutional investors closely monitor market sentiment, which refers to the overall attitude of investors towards the market. Positive sentiment can lead to increased buying activity, while negative sentiment may trigger selling pressure.

- Economic Indicators: Institutional investors analyze various economic indicators such as GDP growth, inflation rates, and employment data to gauge the health of the economy. These indicators help them make informed decisions about their investment strategies.

Impact of Buying and Selling Patterns

- Buying Patterns: When institutional investors collectively buy a significant amount of shares in a particular stock, it can create upward pressure on the stock price. This increased demand can lead to price appreciation, benefiting other investors in the market.

- Selling Patterns: Conversely, if institutional investors start selling off their holdings in a specific stock, it can result in downward pressure on the stock price. This selling activity may trigger a domino effect, causing other investors to also sell their shares and driving the price further down.

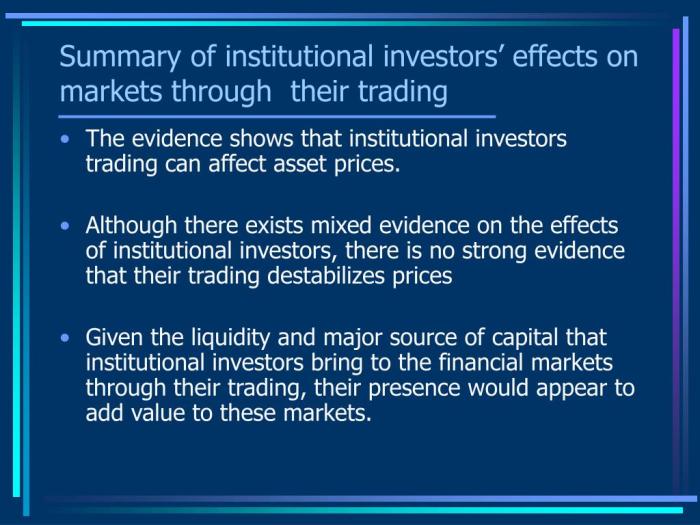

Institutional Investors and Market Volatility

Institutional investors play a significant role in contributing to market volatility. Their large-scale trades and movements in the market can have a substantial impact on stock prices, leading to increased fluctuations and rapid changes in market conditions.

Relationship between Institutional Investor Behavior and Stock Market Fluctuations

Institutional investors’ behavior, such as sudden buying or selling of large quantities of stocks, can cause significant shifts in stock prices. For example, if a major institutional investor decides to sell off a large portion of their holdings, it can create a domino effect, triggering a wave of selling by other investors and driving down stock prices.

On the other hand, if institutional investors collectively start buying a particular stock, it can lead to a surge in its price due to increased demand.

Examples of Institutional Investors Reacting During Market Uncertainty

During times of market uncertainty, institutional investors often adjust their investment strategies to mitigate risks and protect their portfolios. For instance, in the face of economic downturns or geopolitical tensions, institutional investors may choose to reduce their exposure to high-risk assets and increase allocations to safer investments like bonds or gold.

This shift in investment preferences can have a direct impact on market volatility, as sudden changes in demand for different asset classes can lead to price fluctuations across the market.

Last Word

In conclusion, the role of institutional investors in stock movement is not just significant but pivotal in shaping market trends and volatility. By analyzing their investment strategies and reactions during uncertain times, we gain valuable insights into the ever-evolving dynamics of financial markets.

Essential FAQs

How do institutional investors differ from retail investors?

Institutional investors are typically large entities like pension funds and hedge funds that trade in large volumes and have a more significant impact on stock prices compared to individual retail investors.

What are some common investment strategies employed by institutional investors?

Institutional investors often utilize strategies like value investing, growth investing, and quantitative analysis to make informed decisions in the market.

How do institutional investors contribute to market volatility?

Through their large trades and reactions to market conditions, institutional investors can amplify market volatility by influencing stock prices in significant ways.