Exploring Stock Portfolio Diversification Strategies for 2025Money Management Apps vs Professional Advisors opens up a world of financial possibilities. This topic delves into the art of diversification and the evolving role of money management apps and professional advisors in shaping investment decisions.

Let’s embark on this enlightening journey together.

In the following paragraphs, we will dissect the essence of diversification, examine various asset classes, and weigh the pros and cons of using money management apps versus seeking guidance from professional advisors.

Stock Portfolio Diversification Strategies for 2025

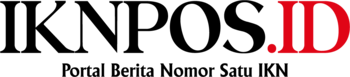

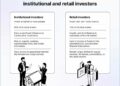

When it comes to managing a stock portfolio, diversification is a key strategy that involves spreading investments across different asset classes to reduce risk. By diversifying, investors can potentially minimize the impact of market fluctuations on their overall portfolio.

Asset Classes in a Diversified Portfolio

- Stocks: Investing in shares of different companies across various industries.

- Bonds: Including government, corporate, and municipal bonds for fixed income.

- Real Estate: Investing in properties or real estate investment trusts (REITs).

- Commodities: Investing in physical goods like gold, silver, or oil.

- Alternative Investments: Such as hedge funds, private equity, or venture capital.

Benefits of Diversification

- Diversification helps spread risk across different investments, reducing the impact of a single asset’s poor performance.

- It can potentially improve overall portfolio returns by capturing gains in different sectors or asset classes.

- Investors can tailor their risk tolerance by adjusting the allocation of assets in a diversified portfolio.

Money Management Apps vs Professional Advisors

In today’s digital age, individuals have more options than ever to manage their investments effectively. Money management apps and professional advisors both play crucial roles in helping individuals make informed financial decisions. Let’s explore the key advantages of using a money management app over a professional financial advisor.

Role of Money Management Apps

Money management apps provide individuals with the convenience of tracking their investments, analyzing trends, and making informed decisions on the go. These apps offer a user-friendly interface that allows users to monitor their portfolios in real-time, set financial goals, and receive personalized recommendations based on their risk tolerance and financial objectives.

Advantages of Money Management Apps

- Accessibility: Money management apps are easily accessible on smartphones and tablets, allowing users to manage their investments anytime, anywhere.

- Cost-Effective: Many money management apps offer low fees or are even free to use, making them a more affordable option compared to professional advisors who may charge higher fees.

- Automation: Money management apps often come with automated features like rebalancing portfolios, tax-loss harvesting, and goal tracking, saving users time and effort.

Personalized Services of Professional Advisors

While money management apps offer convenience and cost-effectiveness, professional financial advisors provide personalized services and expertise that apps may lack. Advisors can offer tailored investment strategies, financial planning, and in-depth analysis based on their clients’ individual needs and goals. They can also provide emotional support during market fluctuations and offer a human touch that apps cannot replicate.

Final Review

In conclusion, Stock Portfolio Diversification Strategies for 2025Money Management Apps vs Professional Advisors offers a glimpse into the future of investment management. By understanding the nuances of diversification and the unique benefits of both apps and advisors, individuals can make informed decisions to secure their financial well-being.

Popular Questions

What is diversification in stock portfolio management?

Diversification involves spreading investments across different asset classes to reduce risk.

What are some examples of asset classes for a diversified portfolio?

Asset classes can include stocks, bonds, real estate, and commodities.

What are the advantages of using a money management app over a professional advisor?

Money management apps offer convenience, accessibility, and often lower fees compared to professional advisors.

What personalized services do professional advisors offer that apps may not?

Professional advisors provide tailored investment advice, financial planning, and expertise based on individual goals and risk tolerance.