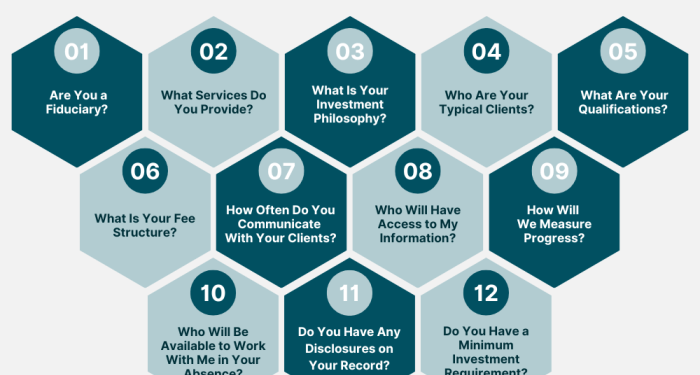

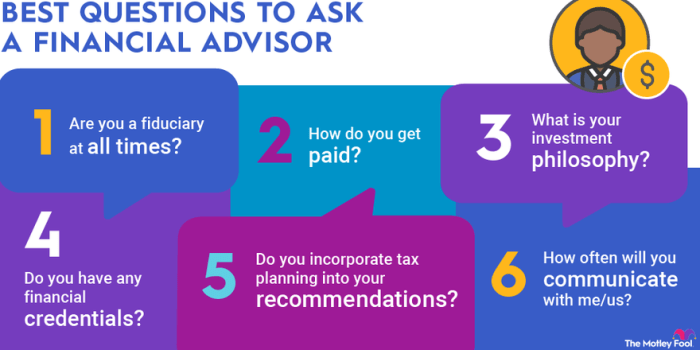

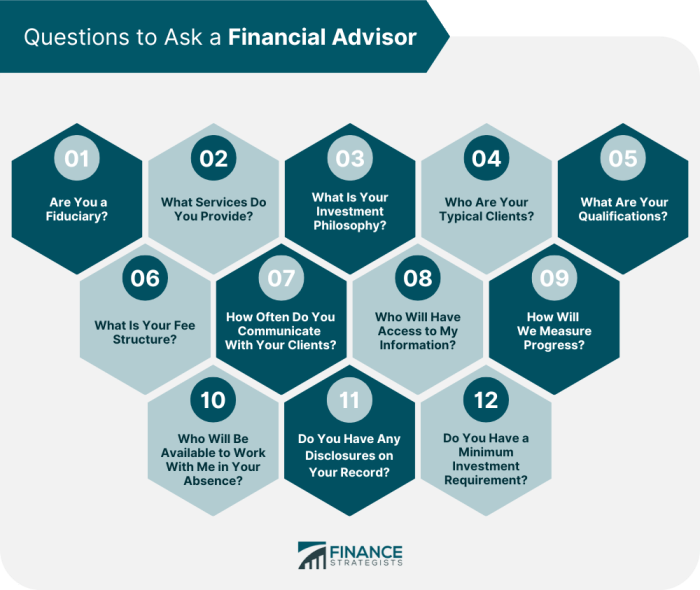

Embark on a journey of financial empowerment with our guide to the top 10 questions you should ask your financial advisor. By delving into these crucial inquiries, you can establish trust, gain clarity, and make well-informed decisions regarding your financial future.

As you navigate through the intricacies of financial planning, understanding the key aspects to inquire about can pave the way for a fruitful partnership with your advisor. Let’s explore the essential questions that can shape your financial well-being.

Importance of Asking Questions

When meeting with a financial advisor, asking questions is a crucial step in ensuring that you make informed decisions about your financial future. By asking the right questions, you can gain a better understanding of your financial situation and goals, as well as the strategies that your advisor recommends.

Building Trust and Understanding

Asking questions can help build trust between you and your financial advisor. It shows that you are actively engaged in the process and that you want to be informed about the decisions being made. Additionally, asking questions can help clarify any doubts or uncertainties you may have, leading to a better understanding of the recommendations being provided.

Leading to Better Financial Decisions

When you ask the right questions, you can gather more information about the risks, benefits, and potential outcomes of different financial strategies. This can empower you to make more informed decisions that align with your goals and risk tolerance. For example, asking about the fees associated with a particular investment or the long-term performance of a certain asset class can help you make more educated choices about your financial future.

Advisor Qualifications and Experience

When choosing a financial advisor, it is crucial to inquire about their qualifications and experience to ensure they are equipped to handle your financial needs effectively.

Types of Certifications

Financial advisors may hold various certifications that demonstrate their expertise in different areas of finance. Here are some common types:

- Certified Financial Planner (CFP): This certification indicates that the advisor has completed extensive training and passed a rigorous exam covering various aspects of financial planning.

- Chartered Financial Analyst (CFA): CFAs are experts in investment management and analysis, making them ideal for clients seeking advice on their investment portfolios.

- Chartered Financial Consultant (ChFC): Advisors with this certification specialize in financial planning and insurance, providing comprehensive advice on these areas.

Importance of Understanding Advisor’s Background

Knowing your advisor’s qualifications and experience is essential because it gives you insight into their expertise and areas of specialization. This can help you determine if they are the right fit for your financial goals and needs.

Fee Structure and Compensation

When working with a financial advisor, understanding the fee structure and how they are compensated is crucial for making informed decisions about your finances.

Financial advisors may use different fee structures to charge for their services. Some common fee structures include:

Fee-Only

In this structure, the advisor is compensated solely by fees paid by the client. This can be an hourly rate, flat fee, or a percentage of assets under management.

Commission-Based

Advisors who work on a commission basis earn money by selling financial products like insurance policies or investment products. They receive a commission for each product sold.

Fee-Based

This structure combines both fees paid by the client and commissions from selling financial products. Advisors may charge a fee for financial planning services and also earn commissions on product sales.

Questions to Ask About Compensation:

- How are you compensated for your services?

- Do you receive any commissions or bonuses for recommending specific products?

- Are there any potential conflicts of interest in how you are compensated?

Potential Impact of Fee Structures:

The fee structure can have a significant impact on your financial plan. High fees can eat into your investment returns and reduce the overall growth of your portfolio. It’s essential to understand how your advisor is compensated to ensure their recommendations are in your best interest.

Investment Strategy and Risk Tolerance

When working with a financial advisor, understanding their investment strategy and how it aligns with your risk tolerance is crucial in achieving your financial goals.

Advisor’s Investment Strategy

It is important to ask your financial advisor about their investment strategy to ensure it aligns with your financial goals and risk tolerance. Some questions you can ask include:

- What is your general investment approach?

- How do you select investments for your clients?

- Can you provide examples of past investment decisions and their outcomes?

Aligning Risk Tolerance

Understanding your risk tolerance and ensuring it matches with your advisor’s investment strategy is crucial for a successful financial plan. It is essential to discuss your comfort level with risk and make sure your advisor’s approach falls within those parameters.

Importance of Understanding Investment Strategy

By comprehending your financial advisor’s investment strategy, you can make informed decisions about your portfolio. Knowing how your money is being invested and the potential risks involved will help you stay on track towards achieving your financial objectives.

Communication and Accessibility

Effective communication and accessibility are crucial aspects of a successful relationship between a financial advisor and their client. Clear communication helps in understanding complex financial matters, making informed decisions, and building trust. Accessibility ensures that clients can reach their advisor when needed, especially during critical times.

Advisor’s Communication Style and Frequency

- Ask your advisor how they prefer to communicate – whether through emails, phone calls, or in-person meetings.

- Inquire about the frequency of communication and whether they provide regular updates on your portfolio and financial goals.

- Discuss how quickly they respond to client queries or concerns.

Importance of Accessibility

Accessibility is vital when working with a financial advisor as it allows you to seek advice or clarification whenever necessary. A responsive advisor can address your concerns promptly, especially during market fluctuations or life-changing events.

Enhancing Advisor-Client Relationship through Communication

- Clear communication can help you understand your financial plan and investment strategies better.

- Regular updates from your advisor can keep you informed about the performance of your investments and any necessary adjustments.

- Open communication fosters trust and transparency in the relationship, leading to better decision-making and long-term success.

Financial Planning Process

Having a structured financial plan is crucial to achieving your financial goals and securing your future. It helps you Artikel your objectives, assess your current financial situation, and create a roadmap to reach your desired outcomes.

Key Questions to Ask

- What is your process for developing a financial plan?

- How do you determine my short-term and long-term financial goals?

- What information do you need from me to create a comprehensive plan?

Importance of a Structured Plan

A structured financial plan provides clarity and direction, helping you make informed decisions about saving, investing, and managing your money. It serves as a guide to monitor your progress, make adjustments when necessary, and stay on track towards financial success.

Approaches to Financial Planning

| Approach | Benefits |

|---|---|

| Goal-Based Planning | Focuses on specific financial objectives and tailors strategies to achieve them. |

| Cash Flow Planning | Emphasizes managing income and expenses to optimize savings and investments. |

| Comprehensive Planning | Considers all aspects of your financial life, including retirement, insurance, taxes, and estate planning. |

Client References and Testimonials

When choosing a financial advisor, it is crucial to ask for client references or testimonials to gain a better understanding of the advisor’s reputation and track record. Client references can provide valuable insights into the advisor’s working style, communication skills, and the results they have delivered to their clients.

Importance of Client References

Client references offer firsthand accounts of the advisor’s performance, professionalism, and ability to meet their clients’ financial goals. By speaking with current or past clients, you can get a sense of the advisor’s strengths, weaknesses, and overall satisfaction level.

- What was your experience working with the advisor?

- Did the advisor communicate clearly and regularly with you?

- Were your financial goals and concerns addressed effectively?

- Did the advisor demonstrate a good understanding of your risk tolerance and investment preferences?

- Have you seen positive results or improvements in your financial situation since working with the advisor?

Insights from Client References

Client references can provide valuable insights into the advisor’s approach to financial planning, investment strategies, and client relationships. By listening to their experiences and feedback, you can assess whether the advisor is a good fit for your financial needs and preferences.

Client testimonials can offer a glimpse into the advisor’s ability to build trust, provide personalized recommendations, and deliver results that align with their clients’ objectives.

Regulatory Compliance and Disclosures

When working with a financial advisor, it’s crucial to inquire about their regulatory compliance to ensure they are operating within legal guidelines. Understanding any disclosures or potential conflicts of interest helps you make informed decisions about your investments. Regulatory compliance not only ensures the advisor follows industry standards but also adds to their credibility and professionalism.

Examples of Questions

- Can you provide information on your licensing and registration?

- How do you handle conflicts of interest that may arise in your practice?

- Are you a fiduciary, and if not, how does that impact our relationship?

Importance of Understanding Disclosures

Disclosures are essential as they reveal any potential conflicts of interest that may influence the advisor’s recommendations. By understanding these disclosures, you can assess the advisor’s transparency and make sure their advice is in your best interest.

Regulatory Compliance for Credibility

Ensuring regulatory compliance demonstrates that the advisor adheres to industry regulations, which is a sign of professionalism and reliability. Compliance with rules and regulations helps build trust between the advisor and the client, showing that they are committed to ethical practices.

Approach to Financial Goal Setting

Setting financial goals is a crucial step in the financial planning process. Discussing these goals with your financial advisor ensures that your investments align with your objectives and aspirations.

Significance of Discussing Financial Goals

When meeting with your financial advisor, it’s important to have a clear understanding of your financial goals. These goals can range from saving for retirement, buying a home, funding your children’s education, or starting a business. By sharing your goals with your advisor, they can tailor a personalized financial plan that helps you achieve these milestones.

Questions to Ask About Goal Setting

- How do you help clients identify and prioritize their financial goals?

- What strategies do you implement to help clients stay on track towards their goals?

- Can you provide examples of how you have helped clients achieve their financial goals in the past?

Role of Goal Setting in Financial Planning

Goal setting plays a vital role in creating a personalized financial plan. It provides a roadmap for your financial journey and allows your advisor to recommend suitable investment options, asset allocation, and risk management strategies to help you reach your objectives.

By regularly reviewing and adjusting your goals, you can stay focused on your financial targets and adapt to any changes in your life circumstances.

Continued Education and Professional Development

Financial advisors who prioritize continued education and professional development are better equipped to provide up-to-date advice and strategies to their clients. Staying current with trends and regulations in the financial industry is crucial for delivering high-quality services.

Importance of Continued Education

Continued education allows financial advisors to deepen their expertise, enhance their skills, and adapt to changes in the market. It also demonstrates a commitment to professional growth and a dedication to serving clients effectively.

- Attending industry conferences, seminars, and workshops to stay informed about the latest trends and best practices.

- Earning advanced certifications and designations, such as CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst), to demonstrate specialized knowledge and expertise.

- Participating in ongoing training programs to learn about new investment products, technologies, and regulatory updates.

Closing Summary

Concluding our exploration of the top 10 questions to ask your financial advisor, remember that knowledge is power when it comes to managing your finances. By actively engaging with your advisor and seeking clarity on these important topics, you can take control of your financial destiny and work towards realizing your goals.

Questions and Answers

How can asking questions benefit my relationship with a financial advisor?

Asking questions helps establish open communication, build trust, and ensure that you have a clear understanding of your financial situation and goals.

What are the different fee structures that financial advisors typically use?

Financial advisors may charge fees based on assets under management, hourly rates, flat fees, or commissions from product sales.

Why is it important to align my risk tolerance with my advisor’s investment strategy?

Aligning risk tolerance ensures that your investments are in line with your comfort level, reducing the chances of making decisions that may not align with your financial goals.

How can client references help me evaluate a financial advisor?

Client references provide insights into the advisor’s track record, communication style, and the overall satisfaction of their clients, helping you make an informed decision.

Why is it crucial for financial advisors to stay updated on trends and regulations?

Continued education ensures that advisors can provide up-to-date advice and strategies that align with the current financial landscape and regulatory environment.